Managing your finances effectively is one of the most important skills you can develop for achieving long-term financial stability and success. Whether you’re just starting your financial journey or looking to improve your current financial habits, learning how to manage money wisely can help you achieve your goals and reduce financial stress.

In this article, we’ll explore practical strategies to help you manage your finances more effectively and build a strong financial foundation.

Why Financial Management is Important

Effective financial management is crucial because it:

- Promotes financial stability: Managing your money well helps you avoid debt and ensures that you can meet your financial obligations.

- Reduces stress: Financial uncertainty can lead to anxiety. When you manage your finances well, you feel more secure and in control.

- Helps you achieve your goals: Wise financial management enables you to save for future goals, such as buying a home, paying for education, or retiring comfortably.

- Improves quality of life: Good financial management gives you more freedom and flexibility in your life, as you’re able to make better decisions with your money.

By learning how to manage your finances effectively, you can take control of your financial future and work toward a stress-free, financially secure life.

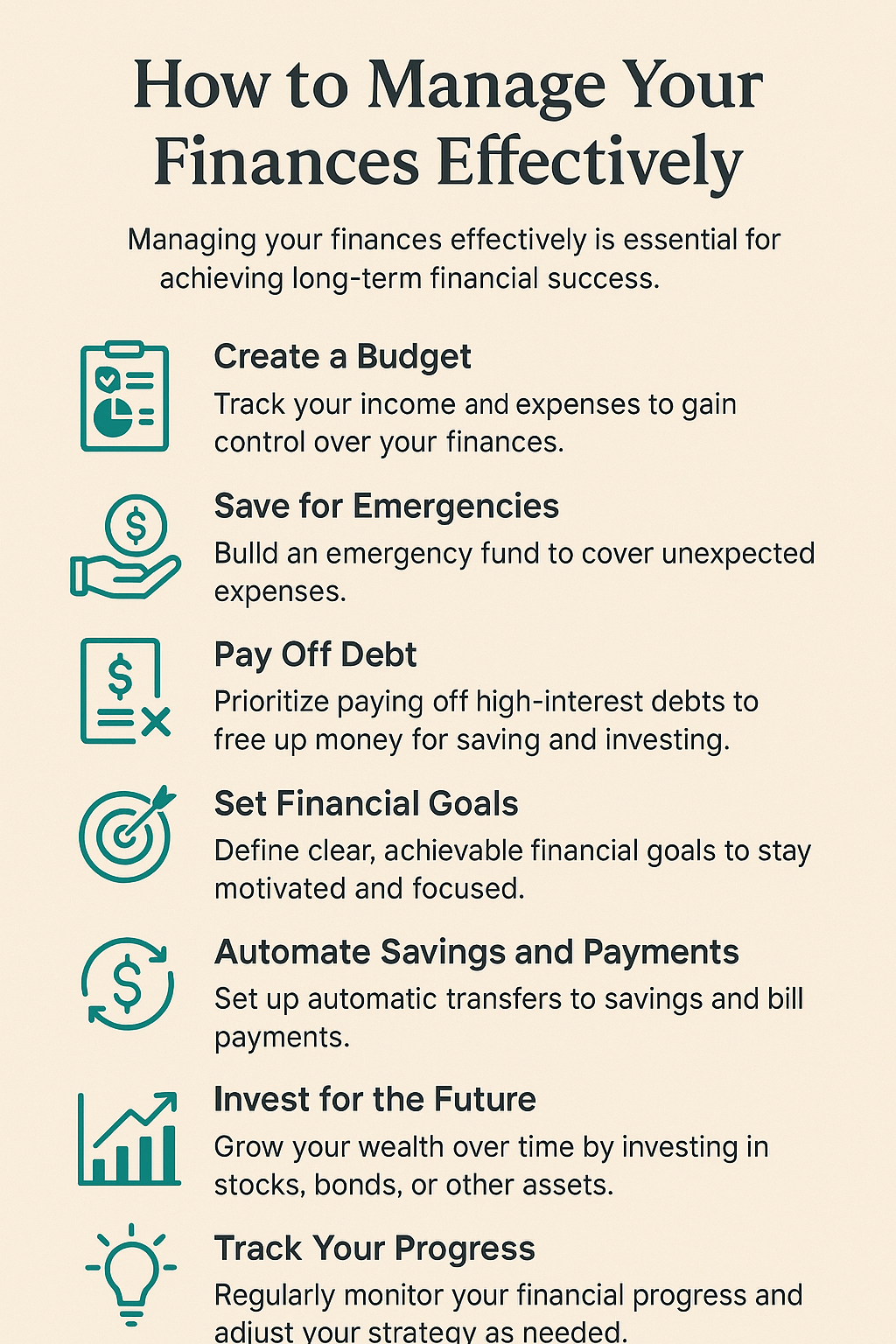

Strategies for Managing Your Finances Effectively

1. Create a Budget

Creating a budget is one of the most important steps in managing your finances. A budget helps you track your income and expenses, so you know exactly where your money is going each month. By following a budget, you can prioritize your spending and ensure that you’re saving for the future.

How to do it:

- Track all sources of income, including your salary, investments, and other revenue streams.

- List your monthly expenses, including fixed costs (rent, utilities, etc.) and variable costs (groceries, entertainment, etc.).

- Allocate a portion of your income to savings and debt repayment.

- Review your budget regularly to ensure you’re staying on track and make adjustments as necessary.

Creating a budget allows you to be intentional with your spending and ensures you’re making progress toward your financial goals.

2. Save for Emergencies

An emergency fund is essential for financial security. It provides a safety net in case of unexpected expenses, such as medical bills, car repairs, or job loss. Having an emergency fund allows you to handle life’s surprises without going into debt.

How to do it:

- Aim to save at least three to six months’ worth of living expenses in an easily accessible savings account.

- Set aside a small portion of your income each month for emergency savings until you reach your goal.

- Keep your emergency fund separate from other savings or investment accounts to avoid spending it on non-emergencies.

Having an emergency fund provides peace of mind and helps you handle unexpected situations without stress.

3. Pay Off Debt

Debt can be a major obstacle to achieving financial freedom. High-interest debt, such as credit card balances, can drain your finances and make it harder to save. Paying off debt is an important step toward financial stability and long-term success.

How to do it:

- List all of your debts, including the total amount owed, interest rates, and monthly payments.

- Prioritize paying off high-interest debt first, using the debt avalanche method, or tackle smaller debts first, using the debt snowball method.

- Consider consolidating or refinancing high-interest debt to lower your monthly payments.

- Make extra payments whenever possible to accelerate debt repayment.

Paying off debt frees up your money for saving and investing, and helps you build a strong financial future.

4. Set Financial Goals

Setting clear financial goals gives you something to work toward and helps you stay focused on your financial journey. Whether it’s saving for a vacation, buying a house, or retiring early, having defined goals keeps you motivated and on track.

How to do it:

- Set specific, measurable, achievable, relevant, and time-bound (SMART) financial goals.

- Break larger goals down into smaller, manageable tasks to make them less overwhelming.

- Regularly review your goals to track progress and adjust your plan as needed.

Having clear financial goals helps you stay focused and ensures you’re using your money in ways that align with your priorities.

5. Automate Your Savings and Payments

One of the best ways to ensure you stay on track with your financial goals is to automate your savings and bill payments. This ensures that you’re consistently saving and paying off debt, without the temptation to spend the money elsewhere.

How to do it:

- Set up automatic transfers to your savings account each month to build your emergency fund and retirement savings.

- Automate bill payments for recurring expenses like utilities, loans, and subscriptions to avoid late fees.

- Use apps or online banking features to automate investments, such as setting up monthly contributions to an investment account.

Automation makes saving and paying bills easy, ensuring that you’re consistently working toward your financial goals without needing to think about it.

6. Invest for the Future

Investing is one of the best ways to grow your wealth over time. While saving is important for short-term financial security, investing allows you to build long-term wealth and achieve your financial goals, such as retirement or buying a home.

How to do it:

- Research different investment options, such as stocks, bonds, real estate, or mutual funds, to find what aligns with your risk tolerance and goals.

- Start investing early to take advantage of compound interest.

- Consider working with a financial advisor to develop an investment strategy that suits your needs.

Investing allows you to build wealth and achieve long-term financial success.

7. Track Your Progress

Regularly tracking your financial progress is essential for staying on top of your goals and adjusting your strategy as needed. By monitoring your income, expenses, savings, and investments, you can make informed decisions and stay focused on your financial future.

How to do it:

- Use budgeting apps or spreadsheets to track your income and expenses.

- Review your financial statements regularly to ensure you’re staying on track with your savings and debt repayment goals.

- Set aside time each month to review your progress and make adjustments as necessary.

Tracking your progress keeps you accountable and ensures you’re moving in the right direction.

Conclusion: Financial Management is Key to Long-Term Success

Managing your finances effectively is essential for building a secure financial future. By creating a budget, saving for emergencies, paying off debt, setting goals, automating savings, investing, and tracking your progress, you can take control of your money and work toward long-term success.

Remember, good financial habits take time to develop, but with consistency and discipline, you can achieve your financial goals and enjoy peace of mind about your financial future.